Irs Meals Deduction 2025. Here are the standard deduction amounts for the 2025 tax returns that will be filed in 2025. For example, if a meal costs $100, you may deduct $50.

Here’s how those break out by filing status:. Tax planning is a major part of owning and running a successful business.

100 Deduction for Business Meals in 2025 and 2025 Alloy Silverstein, Find current rates in the continental united states, or conus rates, by. The meals and entertainment tax deductions have been a valuable.

IRS Standard Deduction 2025 What is it and All You Need to Know about, People should understand which credits and deductions they. The irs has specified certain circumstances under which you can claim 100% deductions for meals in 2025.

IRS Changes for Meals and Entertainment Blueprint, Meal expenses incurred by a taxpayer are deductible only if the expenses satisfy the following strict requirements imposed by the code: One of the key changes in meal deductions in 2025 is the reduction in the deductible percentage.

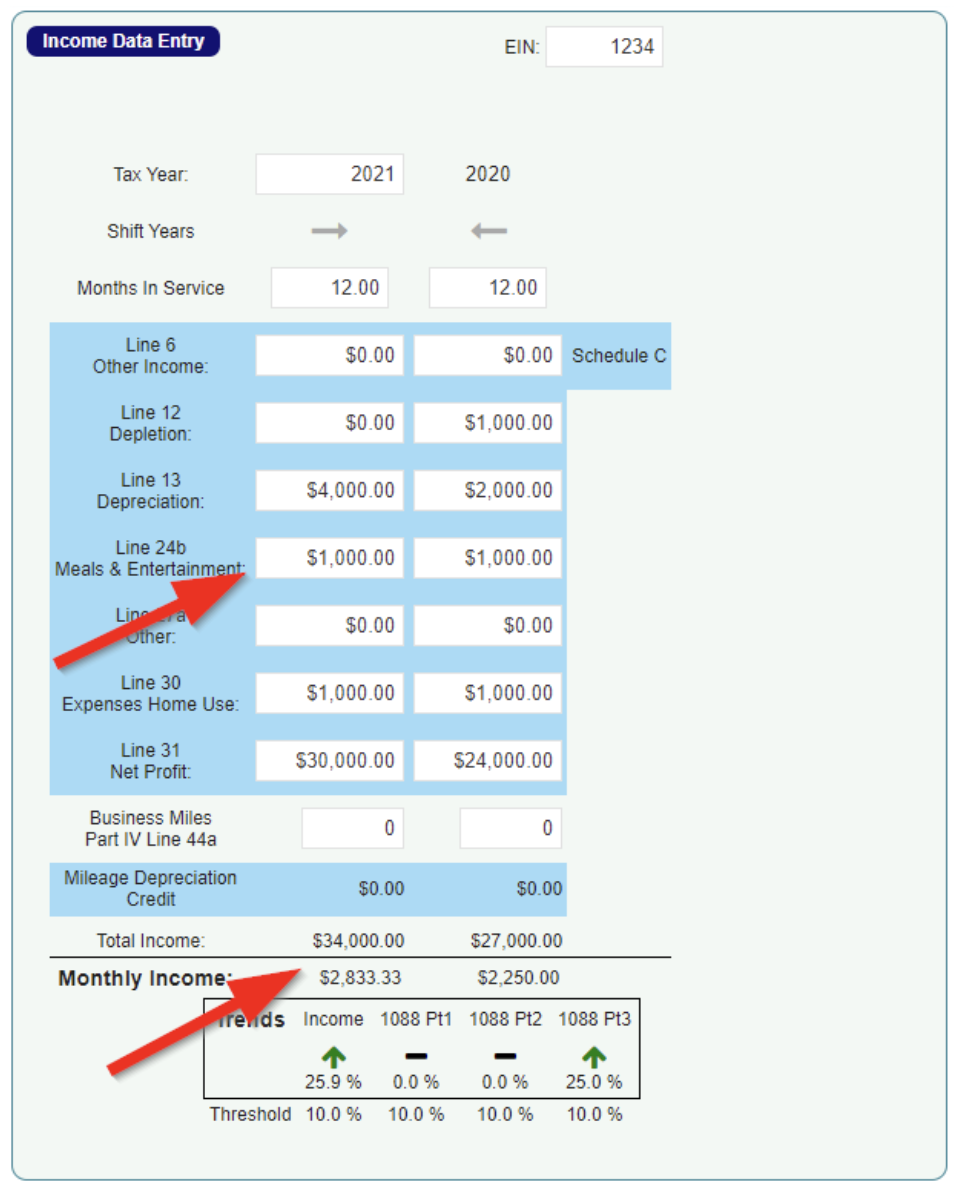

Can You Still Deduct Meal Expenses? Polston Tax, For 2025 and 2025, most business meals are only 50% deductible, according to the current irs rules. Find current rates in the continental united states, or conus rates, by.

Meals & Entertainment Deductions for 2025 & 2025, Here are the standard deduction amounts for the 2025 tax returns that will be filed in 2025. (50% of their cost can be deducted.) business meal tax deduction | how to write off food.

IRS Issues Final Regs on Meal and Entertainment Deduction CPA, There are seven (7) tax rates in 2025. In 2025 and 2025, food and beverages purchased from a restaurant were 100% deductible.

What Is The Standard Deduction For 2025 Grata Brittaney, Entertaining clients (concert tickets, golf games, etc.) 0% deductible: 4, 2025 — tax credits and deductions change the amount of a person’s tax bill or refund.

2025 Meal & Entertainment Deductions Explained Spiegel Accountancy, Find current rates in the continental united states, or conus rates, by. 50% deductible (100% for tax years 2025 and 2025) food for charitable causes.

How to Deduct Business Meals in 2025 Ultimate Guide, Meal expenses incurred by a taxpayer are deductible only if the expenses satisfy the following strict requirements imposed by the code: The internal revenue service (irs) has issued final regulations that clarify the business expense deduction for meals and entertainment, providing further guidance under the.

.png)

IRS meals and entertainment deduction 2025, What is the meal deduction for 2025? Find current rates in the continental united states, or conus rates, by.